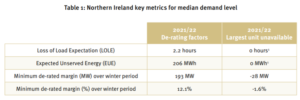

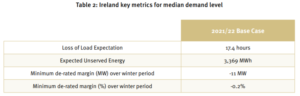

On October 11th, EirGrid published their Winter Outlook for October 1st 2021 – April 4th 2022. For NI, EirGrid’s analysis anticipates a de-rated capacity margin range of 288MW in a low demand scenario falling to 200MW in high demand and -28MW with the loss of a single large unit in the high demand scenario. For ROI, the analysis de-rated capacity margin range is between -144MW and 93MW. This outlook is within the existing security standard for NI (2.2 hrs vs 4.9hrs standard) but outside the standard for ROI (17hrs vs 8hr standard).

EirGrid publish Winter Outlook

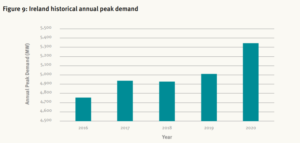

Following a 7% increase between 2019 and 2020, the level of peak demand in ROI is expected to continue to rise this winter, of an order between 5430MW and 5680MW, surpassing the existing record for ROI and possibly breaching the all-island record (6904MW). Analysis of peak demand over the past two winters indicates that a 1°C decrease in outside temperature results in a 40 MW increase in peak demand (50 MW when wind-chill is taken into account).

The Winter Outlook suggests that Northern Ireland risks entering the Alert State if there is a loss of just a single large unit, most likely at periods of low wind and interconnector imports. EirGrid deem there to be a low risk of the system in NI entering an Emergency State due to insufficient generation. November and February are expected to be the tightest periods in NI this winter from a capacity margin perspective.

The assumption in the most recent GCS of 200 MW support from Ireland to NI on the North-South Interconnector has now been reduced to 100 MW based on the tight margins expected in Ireland this winter.

EirGrid expect the system in Ireland to enter the Alert State at times, most likely at periods of low wind and low interconnector imports. There is an elevated risk of the system entering the Emergency State this winter, compared to previous winters, due to insufficient generation being available to meet the demand. The Expected Unserved Energy (EUE) (the expected amount of energy, based on the LOLE, not supplied during a period due to insufficient generation being available) figure suggests that, on average, electricity consumers could be without supply for approximately 40 minutes, approximately double the duration if the 8-hour LOLE standard was met. This does not necessarily mean that electricity consumers will be without supply for any period. This is just a measurement of the risk or likelihood of such an event happening. The system is expected to be tightest in November and early March.