Eurelectric grid investment study: ‘Connecting the Dots’

On the 14th of January Eurelectric and the EDSO launched ‘Connecting the dots: Distribution grid investment to power the energy transition’ a study carried out by Deloitte. The study follows Eurelectric’s Guide on EU Financing and Funding for energy infrastructure published on the 14th of December which aims to determine whether funds are sufficient for DSOs and whether they are adequately used. The Guide on EU funding identifies financing tools and conditions of eligibility (grants, loans or guarantees) and focuses on 5 instruments: Connecting Europe Facility – Energy (CEF), Cohesion Funds and the European Regional Development Fund (ERDF), Horizon Europe, InvestEU, and the European Investment Bank loan facility.

The Guide finds EU funding is marginal in comparison the amounts invested by DSOs. During the last EU budget cycle, DSOs used more loans and guarantees (€16bn) than grants (€1bn). Some instruments have underfinanced distribution grid projects in comparison to transmission grid or gas networks projects. This could be due to financial, regulatory or political gaps and barriers that prevent or disincentivise companies to access EU grants or loans.

The main takeaways for each of the 5 instruments are as follows:

- The EIB provides the most financial support with €14.8bn loans in the last budget cycle.

- CEF-Energy underfinances electricity distribution grids due to restrictive eligibility criteria defined in the TEN-E Regulation. For example, smart grids have received 10x less grants from CEF-Energy than gas networks or electricity transmission networks (€135m out of €4.8bn total budget).

- Cohesion and Regional Funding have allocated only €860m of grants, or 3.7% of total available funding for energy production and networks, to distribution grid projects. These funds are meant to be adapted to smaller infrastructure projects but the use by DSOs remains insignificant compared to the total accessible budget (€272bn).

- Since 2015, the EFSI has provided €1.1bn worth of guarantees and 44% more guarantees to gas networks in comparison to electricity transmission and distribution networks.

- DSOs are the top recipient of grants from Horizon Europe, ahead of electricity transmission and gas infrastructures with €327m grants.

European Institutions have acknowledged the crucial role of the distribution system in the electricity value chain. An EU body for DSOs on technical subjects is set to be established in Spring 2021. This EU DSO-Entity will be a counterpart to ENTSO-e on drafting EU regulation in the form of Network Codes affecting distribution matters. Eurelectric envisages the recent revision of the TEN-E regulation, which will come into force by 2023, to incentivise power distribution investments which will enable DSOs to be key players in the decarbonisation efforts of European economies through the means of increased electrification.

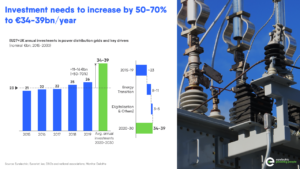

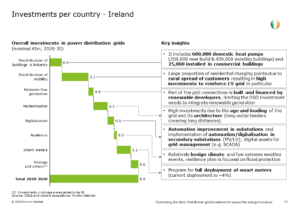

‘Connecting the dots’ aims to bridge the knowledge gap on investment drivers and the estimated volume of investment needed for distribution grids across the EU. The study finds that grid investments need to increase 50-70% in the 2020s compared to the last decade, amounting to €375-425 billion. There are three driving forces for this level of investment.

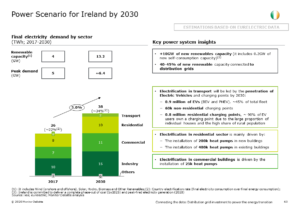

- Connecting renewables – 70% of variable renewables will be connected at the distribution level (although in Ireland they estimate only 43% will be connected at the distribution level).

- Electrification of industry, transport and buildings will trigger new grid build-out.

- Modernisation of the ageing infrastructure – this should be the first area of investment in most EU countries. Roughly one-third of EU grids are already over 40 years old. This is likely to increase to more than 50% by 2030.

The right framework conditions and smart tariff design will ensure the annual investment needs of €34-39 billion will have a moderate impact on electricity prices and grid tariffs. The clean energy transformation will bring about savings of over €175 billion in fossil fuel imports annually to the EU and could reduce average electricity costs by €28-37 billion in the long term.

The study shows that 90% of investments could contribute to the economic recovery from Covid-19. It is estimated the investment in distribution grids will sustain 440,000-620,000 jobs per year. Eurelectric calls on policymakers to improve investment frameworks and tariff design, facilitate access to EU funds and accelerate the authorisation and permit granting process.