The Household Energy Price Index (HEPI) report is a monthly publication which analyses electricity and natural gas prices for customers in 33 capital cities across Europe. Commissioned by the Austrian energy regulator (Energie-Control) and the Hungarian Energy and Public Utility Regulatory Authority (MEKH), this report, produced by VaasaETT, aims to provide up-to-date price comparisons with consistent reporting methodology.

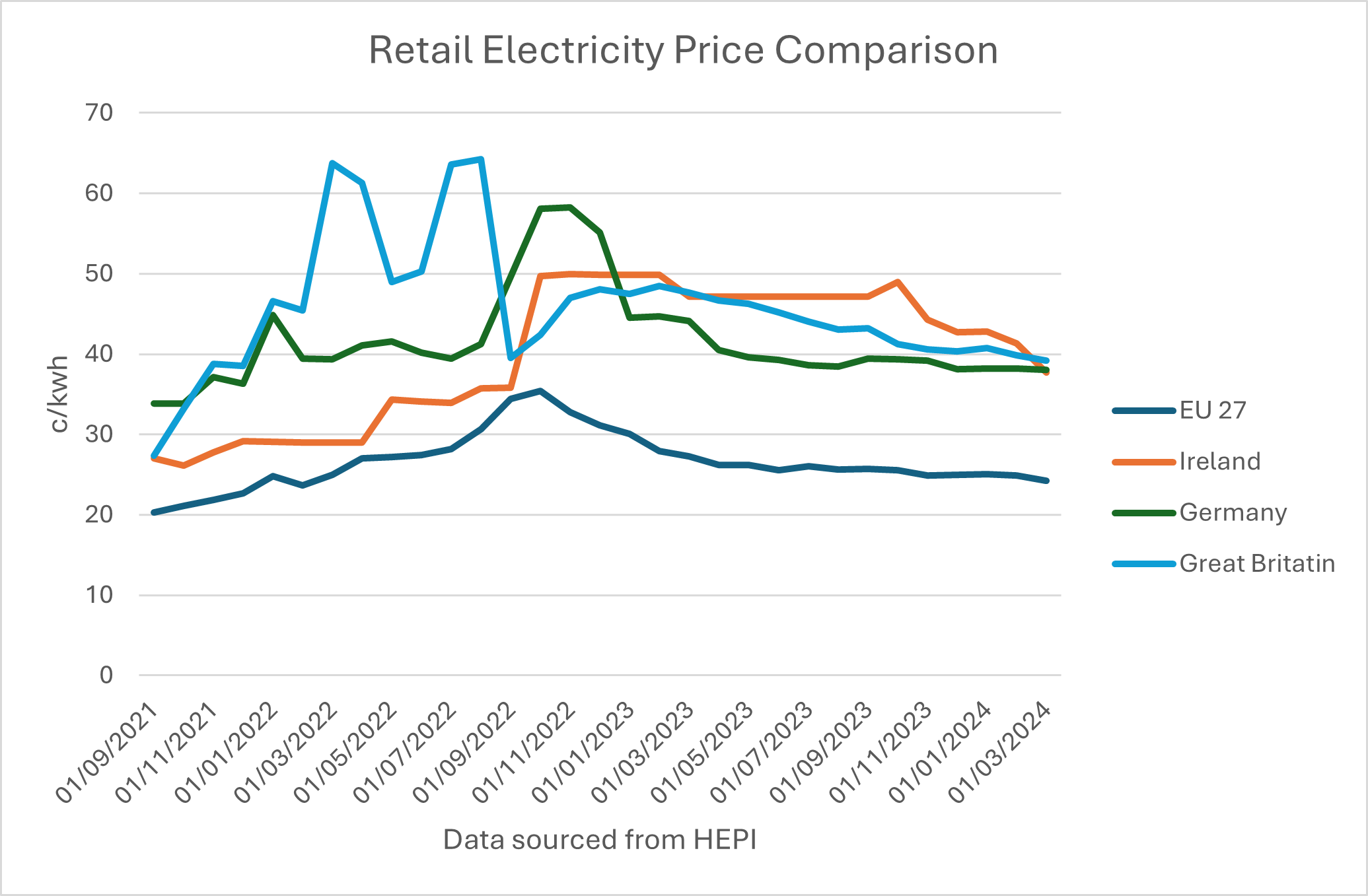

The report shows the end-user price of electricity on the 1st of each month. For March, Dublin emerged as being the fourth most expensive city for electricity in Europe, excluding subsidies, with the residential electricity price including taxes of €37.72cent/kWh. This is cheaper than London, Prague and Berlin, although greater than the EU average of €24.25cent/kWh. This data is a snapshot, however a broader perspective reveals a more accurate scenario. Taking data from the HEPI report since September 2021, and not including the energy credits received, Ireland drops to fifth place in Europe behind Great Britain, Denmark, Germany and Italy on price. What is also evident is that European counterparts raised their prices earlier and higher than Irish suppliers, again shielding Irish customers from price volatility by smoothing out rapid increases in price over a longer time period. This is shown in the graph below.

It is worth noting that this report is not indicative of the actual cost felt by the customer as it does not factor in electricity credits, or other payments from suppliers to customers. Over the winter period, Irish electricity customers will receive €450 credit on their bills, delivered in three instalments of €150. The first two instalments have been paid, with the third either received by customers or due before the end of April. Factoring in the credit, and assuming its contribution to 57% of the electricity bill for the month, based on typical consumption patterns, the cost of electricity is more than halved, at €16.29c/kwh[1]. This may be lower or higher, depending on electricity usage. Similarly, in winter of 2022/2023, Irish electricity customers received €600 in electricity credits, which had a significant impact on the cost felt by customers over this period.

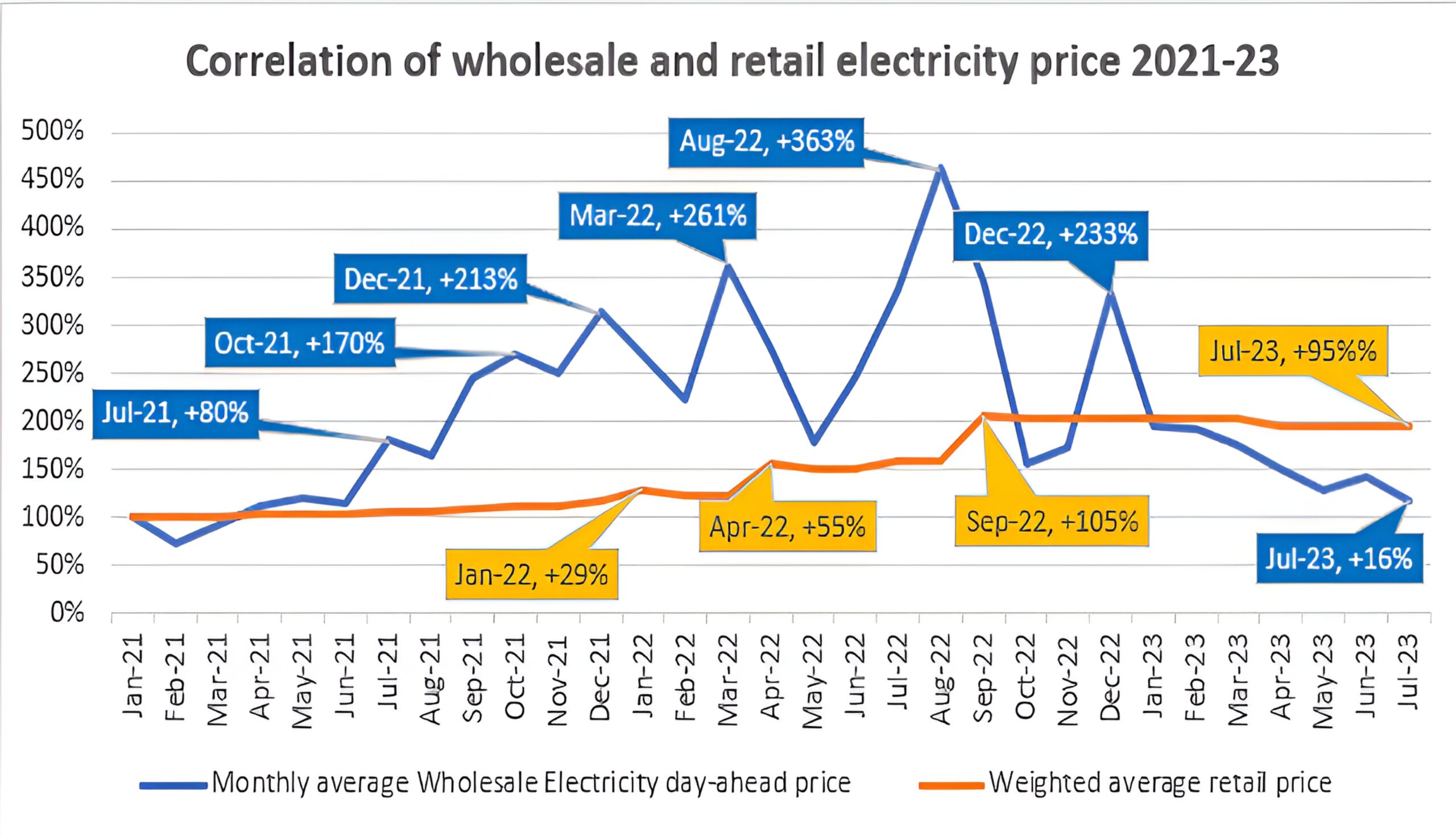

The prices experienced by customers is determined by the wholesale price of electricity. Suppliers hedge on behalf of their customers on the wholesale market to shield them from frequent price fluctuations. This results in the retail market lagging behind the wholesale price. As wholesale prices began to increase over the summer of 2021, peaking in March of 2022, electricity customers were protected from over a three-fold increase in prices through hedging. Since those peaks in 2022, wholesale electricity prices have dropped; however, they remain nearly twice as high as the pre-crisis levels.

(CRU Report on Retail Energy Market, September 2023)

On the retail market, suppliers are steadily reducing their prices, with a 9% decrease in retail prices across the market, from February to March. This relationship between wholesale prices and retail prices is shown in the graph below.

When the CRU completed a detailed analysis of retail electricity prices in 2022 they found no evidence of excess profits in the retail market sector[1]. During the price crises, four suppliers exited the markets and three suppliers, which supply over 80% of the electricity customers either returned their 2022 profits to customers or were loss-making in the period (Report on Retail Energy Markets, CRU 2023: linked here). This report further states that retail prices are reflective of cost drivers.

The 2023 Spending Review from IGEES in 2023 referred to the relationship between the wholesale market and retail electricity prices states, ‘Retail price reductions were not likely before the period spanning late Q4 2023 to Q1 2024. Additionally, a more sustained period of lower wholesale prices will be needed before retail prices fall back close to levels seen at the start of 2021. This analysis is consistent with price reductions announcements by retail energy (electricity and gas) suppliers, with most price reductions having occurred in November 2023.’[2]

Irish wholesale prices for electricity are typically higher than our European counterparts. This is due to our current reliance on gas for electricity production, 48% in 2022, which we import 75% of our gas demand from the UK according to Gas Network Ireland. This high dependency on fossil fuels and a reliance on imports exposes the Irish market to volatility. We also have higher network costs per capita due to our disbursed population.

Acknowledging that Irish prices are higher than other European countries, energy suppliers are committed to helping customers who may be having difficulty with their energy bills. Throughout the crises, suppliers spearheaded a variety of initiatives and in October 2023, energy suppliers relaunched the Energy Engage Code. The Energy Engage Code is a voluntary commitment that sets out how suppliers will help and support customers to manage their energy bills (electricity and gas). It is a coordinated industry-led approach and aims to encourage customers to communicate with their supplier, who will tell you about the supports available. The key principle underpinning the code is a firm commitment by suppliers that they will never disconnect an engaging customer.

[1] CRU Report on Retail Energy Markets (September 2023)

[2] A Review of Electricity Prices and Supports in the Context of the Energy Crises, Government of Ireland, 2023 (Access here: 288195_19a7740b-3db8-4303-bbef-e391555574c7 (3).pdf)