On Tuesday 18th of May, the IEA published their global net-zero by 2050 roadmap. The roadmap is a viable pathway that includes 400 milestones that need to be achieved to bring the global energy sector to net-zero GHG emissions by 2050 consistent with a 1.5°C limit of average global temperatures. The pathway is narrow and requires immediate action to transform the production, transportation, and use of energy across the world.

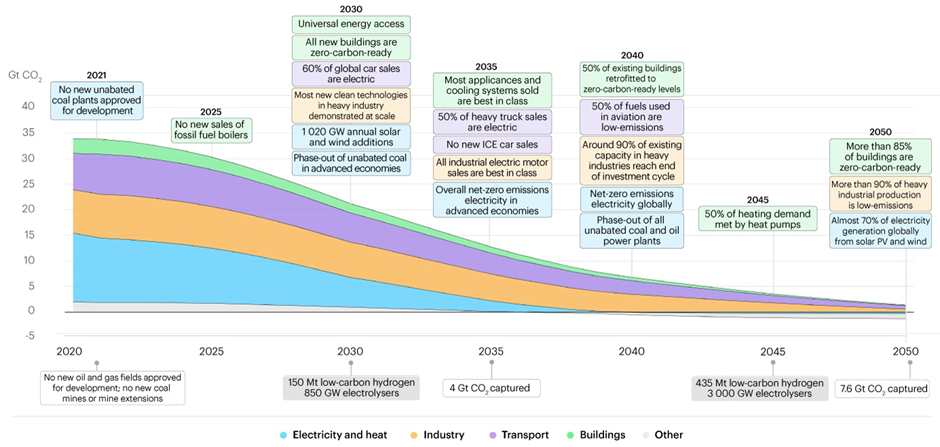

Some of the milestones include no new oil and gas field developments approved from 2021, halting sales of fossil fuel boilers by 2025, no new ICE car sales by 2035, phasing out unabated coal and oil power plants by 2040.

Electricity generation will need to reach net-zero emissions globally and be on its way to supplying almost half of total energy consumption by 2040.

The IEA outlook for 2050 sees solar as the largest energy source with renewables providing ~90% of electricity, one-fifth of which is used to produce hydrogen. On the global net-zero pathway the world will need 4 times the amount of wind and solar it had in 2020 by 2030. By 2050 the world will need 20 times the amount of solar and 11 times the amount of wind capacity. Reducing the roles of nuclear power and carbon capture would require even faster growth in solar PV and wind, making achieving the net-zero goal more costly and less likely. Energy efficiency improvements will need to triple the average rate seen over the last two decades.

They estimate clean energy investments will increase from ~$1 trillion in 2020 to over $4 trillion in 2030. Innovation will also have to leap forward, with half of the emissions reductions in 2050 due to come from technologies that are still in development. Electricity network investment is to triple by 2030 and remain elevated out to 2050. Global electricity networks that took over 130 years to build need to more than double in total length by 2040 and increase by another 25% by 2050. Meeting new demand is the main driver for network investment while replacing ageing infrastructure and integrating more renewables also requires investment.

In terms of energy security, the IEA shifts its focus to a smaller group of oil producers, critical mineral supplies and flexible, cyber-resilient electricity systems. Traditional energy security concerns will not disappear, as oil production will become more concentrated. The total market size of critical minerals like copper, cobalt, manganese, and various rare earth metals is to grow almost sevenfold over the next decade in the net zero pathway, with revenues from those minerals set to be larger than revenue from coal this creates new opportunities for mining companies. It also creates concerns for energy security e.g., price volatility, additional costs for transitions and if supply cannot keep up with increasing demand.

The transition calls for major increases in all sources of flexibility for electricity systems around the world including batteries, demand response and low-carbon flexible power plants, supported by smarter and more digital electricity networks. The resilience of electricity systems to cyberattacks and other emerging threats needs to be enhanced. Governments need to create markets for investment in batteries, digital solutions and electricity grids that reward flexibility and enable adequate and reliable supplies of electricity.

Without global cooperation and immediate action from governments, the IEA predicts it will take several decades longer to achieve net-zero energy-related emissions – possibly not until 2080 – 2090.